Top Ugandan officials have been boxed into a corner of bother after lenders in China rejected their request to re-negotiate ‘toxic clauses’ in the $200m (Shs713b) loan picked six years ago to expand Entebbe International Airport.

Some of the unfavourable provisions in the loan agreement that Uganda signed with the Export-Import (Exim) Bank of China on March 31, 2015, if not amended, expose Uganda’s sovereign assets to attachments and take-over upon arbitration awards in Beijing.

Our investigations found out that any proceedings against Uganda Civil Aviation Authority (UCAA) assets by the lender would not be protected by sovereign immunity since Uganda government, in the 2015 deal, waived the immunity on airport assets.

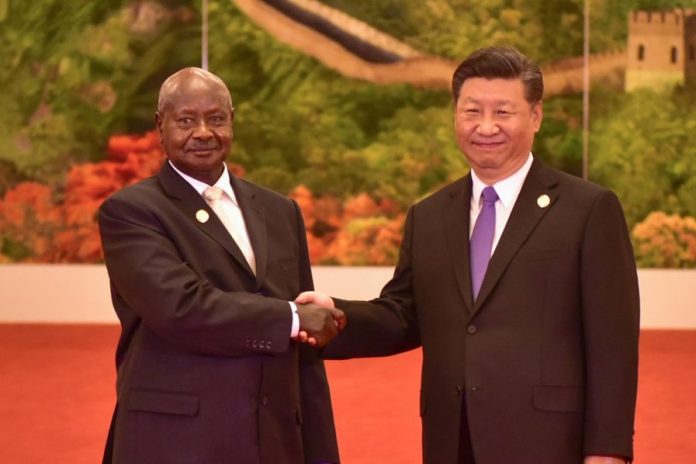

Highly-placed sources said the risk presented by the Financing Agreement on March 7, 2019, prompted Uganda to send an 11-member delegation to Beijing to plead with Exim Bank to renegotiate the clauses now impugned by Kampala.

Foreign Affairs

The joint team from the Works, Foreign Affairs, and Finance ministries, as well as UCAA and Attorney General’s Chambers, was led by Dr Chrispus Kiyonga, Uganda’s Ambassador to China.

In the meeting, the four Exim Bank executives reportedly rejected any amendments to clauses of the signed Financing Agreement, and made it clear to the Ugandan executives that any attempts to make alterations would set a bad precedent. In addition, the Chinese told their guests that they saw no cause to warrant the amendment.

The lenders advised Dr Kiyonga and his team to accept “friendly consultations” from time to time, to ensure smooth implementation of the airport expansion project. They also agreed to keep the details of the meeting confidential.

China freezes cash

Our investigations over several months show that Uganda dispatched a delegation to Beijing after Exim Bank suspended funding, citing violation of the loan agreement after UCAA failed to implement some of the clauses, which were not favourable to Uganda.

The loan agreement requires UCAA to set up an escrow account to hold all of the Authority’s revenues.

An escrow is a contractual arrangement in which a third party receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties, according to Wikipedia.

The agreement provides that UCAA cannot use any of the accrued money for whatever expenditure without approval from Beijing.

Realising that some of the loan agreement clauses were not being implemented, Exim Bank froze cash flow to the contractor, a Chinese company.

For instance, the construction firm’s payment certificate No.11 up to 23, amounting to $24.5m (Shs87b) for work done from December 2017 to February 2019, were not paid.

Lack of finances affected the contractor and work slowed down almost to a standstill. By the time the Chinese accepted to resume funding, the project had lost 361 days and the country was under lockdown.

“These conditions were not palatable for an international airport of a sovereign State whose operations are dynamic and sometimes unpredictable,” UCAA noted in its latest response to queries by Parliament.

The Chinese agreed to resume bankrolling the project, but refused to amend the problematic clauses that they signed with the government of Uganda.

They instead proposed a clarification of the contentious clauses, which UCAA now considers insufficient.

While the initial agenda of the meeting in Beijing was to cause a re-negotiation of specific clauses in the original Financing Agreement, Finance Minister Matia Kasaija, in his response to the aviation and Works ministry officials, noted:

“The Exim Bank officials made it clear from the onset that re-negotiation and amendment of the loan agreement were not agreeable to them.”

In two letters with similar content, but dated differently; September 5, 2019 and January 14, 2020, Mr Kasaija told former Works minister Monica Azuba Ntege, that the meeting in Beijing endorsed a mutually-agreed ‘minute of resolutions’ reached as an output rather than amendment of the loan agreements clauses that have left Ugandan officials restless.

“It was the understanding of all parties that to achieve a win-win situation, the contentious clauses would be interpreted with a view of having a balanced effect that would enable resumption of disbursements without necessarily amending the agreement,” Mr Kasaija’s January 14, 2020 letter reads in part.

Consternation

In the corridors of Works and UCAA, Mr Kasaija’s response on the matter according to sources, was treated with disdain for allegedly blind-spotting a deal that presents real risks to Uganda’s sovereign assets.

The technocrats accused the minister of risking Entebbe International Airport, and other national assets, and Works ministry specifically demanded a speedy resolution of the problematic clauses.

On September 8, the then UCAA acting director general, Mr Fred Bamwesigye, now the substantive office holder, wrote to Works Minister Gen Edward Katumba Wamala, reminding him about the need to renegotiate the loan Financing Agreement.

He also requested him to remind Minister Kasaija to notify Exim Bank of the need to amend the agreement to make it consistent with Uganda’s and international law.

“Whereas some of the provisions referred to were alluded to in the Minutes of the Negotiations, the unfair clauses remain embedded in the agreements, while in some cases, they were not dealt with at all… There is, therefore, an urgent need to start the review and renegotiation of the Government Concession Loan Agreement…in order to reduce the intentions of the parties into a legally-binding agreement,” Mr Bamwesigye wrote. He attached a list of unfair clauses in the agreement.

Bounced to AG

Ms Susan Kataike, the Ministry of Works spokesperson, and her Finance counterpart Jim Mugunga, declined to comment on the impugned loan agreement clauses that have turned into a legal and diplomatic conundrum for Uganda.

They referred this newspaper for explanation to Attorney General Kiryowa Kiwanuka, who is just five months on the job yet government picked the loan six years ago.

Mr Kiryowa was in Parliament and unable to speak when we contacted him yesterday.

Solicitor General Francis Atoke, the top technocrat in the Attorney General’s office, said he was not aware of the problematic clauses in the agreement and, therefore, unable to comment.

We were unable to reach Exim Bank officials in China by press time.

Toxic clauses

Back in Uganda, UCAA officials, have flagged up to 13 clauses in the agreement as “unfair and erode the sovereignty of Uganda”.

The agreements authorises Exim Bank to approve UCAA withdrawals yet there is a statutory board mandated to do so.

“It’s clear that [U]CAA will lose its rights of use and control over its revenues…. as a self-financing institution with limited funding. Such provisions would expose the organisation to risk of failure in service delivery and bankruptcy,” a source said.

Among the controversial provisions is a surrendering under the airport loan agreement of the approval of UCAA budget, master and strategic plans, which ordinarily are the mandates of the aviation regulator’s board, to Exim Bank in Beijing.

“This also exposes UCAA to risk of failure to deliver its mandate, and infringes on State’s effective control over UCAA,” Prof David Kakuba, then the UCAA director general, who retired in June last year, wrote. He added: “There is, therefore, urgent need to start the review and renegotiation of the Government Concessional Loan Agreement on the upgrading and expansion of Entebbe International Airport Phase I project, together with [other] agreements…in order to reduce the intentions of the parties into a legally binding agreement.”

The Government Concessional Loan Agreement provides conditions for signing three other agreements: On-lending agreement between Uganda and UCAA; Repayment Mechanism Agreement between Exim Bank and Uganda and [U]CAA and then, Escrow Account Agreement between Uganda, UCAA and Exim Bank.

Under Section 3 of the Repayment Mechanism Agreement and Section 3.1 (a) of the Escrow Account Agreement, it’s required that Annual Operating Budgets for UCAA will be prepared and submitted for approval to both government and Exim Bank. Under subsection (b), Exim Bank has the right to reject or approve the budgets.

Similarly, monthly operating budgets are to be approved to the escrow account in a form acceptable to Exim Bank. The bank is also authorised to inspect both UCAA and government Books of Accounts, which erodes the sovereignty of the State.

More gaps

Whereas Section 14.1 of Repayment Mechanism Agreement provides that the governing laws shall be the laws of Uganda, Section 14.2 provides that all disputes shall, where mutual discussions fail, be resolved by the China International Economic and Trade Arbitration Commission (CIETAC) in Beijing. This, according to UCAA brief to Kasaija, “directly undermines the legal regime to which the entire agreement is subject to.”

Section 11.1 (f) of the Escrow Account Agreement put emphasis on the fact that the arbitration in Beijing court is legal, valid, binding and enforceable to the extent that any award obtained in CIETAC will, if introduced, be received and accepted for enforcement in any proceedings against the borrower, end-user and the Exim Bank and their respective assets in Uganda.

Red flag

On December 11, 2019, Prof Kakuba warned Mr Kasaija that Exim Bank can legally enforce any clauses of the loan agreement notwithstanding its omission to do so earlier.

“Any seeming delay or any form of understanding that is not reduced into an amended agreement of the signed ones, would maintain the enforceability by Exim Bank of the disputed agreement,” he wrote.

Section 10.3 of the Repayment Mechanism Agreement provides for waiver of immunity, and states as follows:

“Each obligor hereby irrevocably waives any immunity on grounds of sovereign or other immunity for itself or any of its property in connection with any arbitration proceeding or with enforcement of any arbitral awards any court judgement.’

Such a provision, if not amended, argued Prof Kakuba, “exposes government assets to attachments and take-over upon arbitration awards in China”.

MPs grill Kasaija

During the October 28 interface with Cosase, members tasked Mr Kasaija and his technical team to explain the airport loan agreement. He told them they did due diligence, but he could not explain how Uganda ended up surrendering its sovereignty to the Chinese for cash.

Mr Juvenal Muhumuza, an assistant commissioner at the Finance ministry, and Ms Molly Apio, a legal adviser at the same ministry, told the parliamentary committee that they reviewed the agreement, especially on the waiver of immunity and that some conditions could not be negotiated.

Ms Apio, however, didn’t tell the committee that the Chinese creditors had outrightly rejected any requests for renegotiation and asked Uganda to respect the loan agreement.

The failure to renegotiate the toxic clauses has exposed Entebbe International Airport and other government assets staked for the $200m loan to seizure.

Cosase members asked Mr Kasaija to furnish them with the checklist used to evaluate the feasibility of the loan agreement for Uganda.

What is at stake?

The revelation that Uganda government signed an agreement and, among others, waived immunity for its sovereign assets has raised questions about the level of scrutiny and due diligence that bureaucrats conduct before committing the country internationally.

Appearing before Parliament’s Committee on Commissions, Statutory Authorities and State Enterprise (Cosase) chaired by Nakawa West Member of Parliament Joel Ssenyonyi on October 28, Finance Minister Matia Kasaija apologised over the less-than-satisfactory scrutiny of the Entebbe International Airport upgrade Financing Agreement.

“In the unlikely event that UCAA were to fail to generate sufficient revenue to service the loan [from Exim Bank), then the central government will step in,” he told journalists after appearing before Cosase.

Mr Kasaija told MPs that they at the time in 2015 considered the China loan offer as the “best possible alternative and jumped on it”, an admission that illuminates how countries walk into what academics and critics brand as Beijing’s ‘debt trap’.

A number of countries, some in Africa, have had to forfeit national assets for direct control by China after failing to repay commercial loans signed with haste or without proper scrutiny, such as the Financing Agreement to bankroll new terminal, cargo and fuel centre works.

For instance, in December 2017, Sri Lanka lost its Hambantota Port to China for a 99-year lease after failing to show commitment in the payment of billions of dollars in loans.

The transfer, according to New York Times, gave China full control of the territory just a few hundred miles off the shores of rival India.

In September 2018, Zambia also lost Kenneth Kaunda International Airport to China over debt gone-wrong. The Chinese lenders were already in control of the country’s state broadcasting company, ZNBC.

Parliament criticised

Although MPs on Cosase queried Minister Kasaija and his technical team over failure to remove toxic clauses before signing the loan agreement, sources in Finance ministry and UCAA, have accused the lawmakers of approving the loan request yet they contained glaring gaps.

Our investigations have also confirmed that the loan in question was scrutinised by Parliament’s National Economy Committee and approved by the whole House.

According to document retrieved from Parliament Library, the National Economy Committee scrutinised this particular loan request, but it didn’t detect the problems in the loan agreement.

On March 24, 2015, the Finance minister presented a formal motion in Parliament, seeking to borrow $325 million (Shs1.1 trillion) from Exim Bank.

However, after scrutiny, the Committee chaired by former MP Xavier Kyooma discovered that $125m (Shs444b) lacked documents.

During the consideration of the National Economy Committee report, presiding Speaker Jacob Oulanyah asked former Planning Minister David Bahati to amend the motion.

After the minister amended the motion, Parliament authorised government to borrow $200m from Exim Bank at two percent upon disbursement, with a maturity period of 20 years, including a seven-year grace period.

The grace period lapses next year.

Authorities at UCAA learnt of the ambiguities in the Entebbe International Airport loan agreement during implementation and notified former Works minister Azuba, who also requested her Finance counterpart Kasaija to notify Exim Bank of the need to amend the loan agreement.

Available documents show that the government borrowed $325m from Exim Bank to finance and upgrade the expansion of Entebbe International Airport.

Exim Bank agreed and released $200m for the first phase of the upgrade and was later to provide additional $125m for the second phase.

The design-and-build contract for Entebbe International Airport project is being implemented by UCAA at a contract price of $200m and supervised by Dar Al-Handasah (Shair & Partners) supervising consultants at a supervision price of $1.18m, including Value Added Tax.

This is not the first project financed by China’s Exim Bank. The bank has funded about 85 percent of two major Ugandan power projects — Karuma and Isimba dams. The Chinese Bank also financed and built Kampala’s $476 million (Shs1.7 trillion) Entebbe Express Highway to Entebbe.

The Daily Monitor