Tremblant Capital Group increased Netflix Inc (NFLX) stake by 17.18% reported in 2017Q2 SEC filing. Tremblant Capital Group acquired 59,784 shares as Netflix Inc (NFLX)’s stock rose 10.41%. The Tremblant Capital Group holds 407,684 shares with $60.91M value, up from 347,900 last quarter. Netflix Inc now has $81.09B valuation. The stock increased 1.18% or $2.19 during the last trading session, reaching $187.39. About 1.08M shares traded. Netflix, Inc. (NASDAQ:NFLX) has risen 75.34% since December 8, 2016 and is uptrending. It has outperformed by 58.64% the S&P500.

GENEL ENERGY PLC (OTCMKTS:GEGYF) had an increase of 25.8% in short interest. GEGYF’s SI was 852,300 shares in December as released by FINRA. Its up 25.8% from 677,500 shares previously. With 3,200 avg volume, 266 days are for GENEL ENERGY PLC (OTCMKTS:GEGYF)’s short sellers to cover GEGYF’s short positions. The stock decreased 2.34% or $0.03 during the last trading session, reaching $1.25. About 100 shares traded. Genel Energy plc (OTCMKTS:GEGYF) has 0.00% since December 8, 2016 and is . It has underperformed by 16.70% the S&P500.

Among 54 analysts covering Netflix (NASDAQ:NFLX), 37 have Buy rating, 2 Sell and 15 Hold. Therefore 69% are positive. Netflix had 202 analyst reports since August 4, 2015 according to SRatingsIntel. On Tuesday, October 17 the stock rating was maintained by UBS with “Buy”. The company was upgraded on Tuesday, February 2 by Piper Jaffray. The firm has “Buy” rating given on Thursday, October 12 by Stifel Nicolaus. As per Tuesday, October 18, the company rating was maintained by UBS. The firm has “Outperform” rating by FBR Capital given on Thursday, October 15. The company was maintained on Monday, September 18 by Piper Jaffray. The company was maintained on Tuesday, July 18 by Oppenheimer. On Thursday, August 25 the stock rating was upgraded by William Blair to “Outperform”. The company was maintained on Tuesday, October 18 by Wedbush. As per Thursday, June 29, the company rating was maintained by RBC Capital Markets.

Investors sentiment decreased to 1.22 in Q2 2017. Its down 0.11, from 1.33 in 2017Q1. It turned negative, as 64 investors sold NFLX shares while 222 reduced holdings. 93 funds opened positions while 256 raised stakes. 344.96 million shares or 1.00% less from 348.44 million shares in 2017Q1 were reported. Rafferty Asset Mngmt Ltd Liability has invested 0.04% of its portfolio in Netflix, Inc. (NASDAQ:NFLX). Ashfield Capital Prtnrs Lc, California-based fund reported 5,266 shares. Vanguard Grp has 27.95M shares. Clinton Grp has 12,438 shares for 0.19% of their portfolio. 678,380 are held by Credit Suisse Ag. Putnam Invs Limited Liability accumulated 7,700 shares. Comerica National Bank reported 0.16% stake. Fisher Asset Management Limited Com owns 1,545 shares or 0% of their US portfolio. Texas Permanent School Fund accumulated 121,100 shares. Intact Invest Mngmt reported 0.02% of its portfolio in Netflix, Inc. (NASDAQ:NFLX). State Of Alaska Department Of Revenue reported 0.01% stake. Edgewood Limited Com reported 3.12% stake. Nippon Life Insur Comm holds 0.04% or 15,044 shares. Waddell Reed Inc reported 631,800 shares. Tech Crossover Vii holds 30.85% or 5.04M shares.

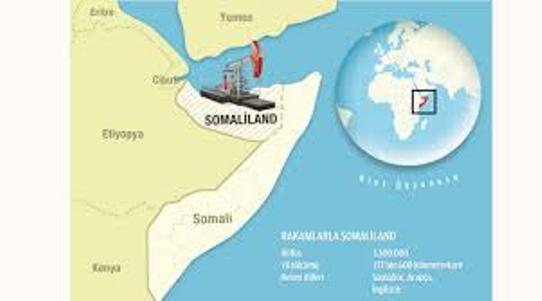

Genel Energy plc engages in the oil and gas exploration and production activities. The company has market cap of $332.65 million. The firm holds interests in the Taq Taq, Tawke, Miran, Bina Bawi, Peshkabir, and Chia Surkh assets in the Kurdistan Region of Iraq, as well as exploration assets in Somaliland and Morocco. It currently has negative earnings. As of December 31, 2016, it had proven and probable working interest reserves of 161 million barrels of oil equivalent.

By Adrian Erickson