Enough of the arguments about the trade-off between profit and impact. Impact investors now have a “trade-on” opportunity, says Arif Naqvi, founder of the global investment group Abraaj. Naqvi coined the term at the UN General Assembly in September, declaring that investors can improve financial returns by creating social value.

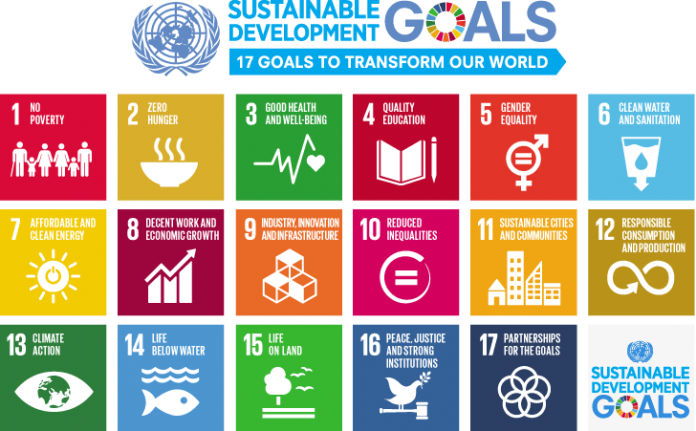

That may seem like good news in light of the $5 trillion to $7 trillion annual Sustainable Development Goals (SDG) financing bill the international aid world hopes to meet with private sector investment. And yet there’s one important problem: Most poor people live in places where investors won’t go.

To achieve SDG 1—ending poverty in all its forms everywhere—we have to find a way to help people with low incomes, who live in high-risk countries, small markets, or remote areas with low population densities and weak infrastructure, where it is still very hard to make money.

Our firm manages private sector development funds on behalf of donors (including bilateral and multilateral donors, private foundations, and corporations) that have given hundreds of pilot grants to help companies solve social problems across 33 African countries. These entrepreneurs are doing amazing work in areas such as off-grid solar services, livestock productivity through cattle genetics, and financial inclusion through advanced credit scoring. So we set up a unit to help them raise debt and equity investments to scale successful projects.

We built a wide network of impact investors and development finance institutions that have completed successful deals with the companies we work with, but feedback from the investors suggested that most of the companies in the portfolio were “nearly uninvestable.” Many were small or had a small market size, or had operations in high-risk or post-conflict states. They were early-stage companies operating on low margins, or with long working capital cycles, long payback periods, or insufficient returns on capital. There was a clear mismatch between company profiles and what impact investors look for.

We interpreted this in several ways. On the one hand, private sector grant portfolios targeting scale might need to be selected more in line with investor appetites. Many of our clients were already pushing toward the use of returnable development capital (mostly soft loans), which would mean thinking like an investor in selecting companies able to repay.

But we felt that aligning more closely with investors could prevent us from working on a lot of projects in places like Somaliland, the Democratic Republic of the Congo, or Sierra Leone, or with companies serving poor rural communities on low-profit margins, or in high-risk sectors like primary agricultural production (farming). These companies were benefiting millions of people and co-financing their projects with private sector money at an average of one to four times the grant capital. But most of the companies would struggle to scale or attract investment. In a time when aid budgets are shrinking, we questioned whether that was the best use of scarce grant capital.

On the other hand, we realized that impact investor expectations have failed to match much of the market reality across Africa. Financial returns on emerging market impact funds have fallen short of investor expectations for over a decade, according to Cambridge Associates data. And the Global Impact Investing Network found that about 90 percent of non-development financial institution impact investment capital deployed across sub-Saharan Africa has gone to just eight countries: Kenya, Tanzania, Uganda, Nigeria, Ghana, South Africa, Angola, and Zambia. Investments have been further concentrated in urban and peri-urban communities.

So how do we reach people in the dozens of other countries and thousands of communities where many investors won’t go?

We think private-sector development grants still have several essential roles to play:

1. Driving coherent development

One popular answer to the limitations of impact investment in Africa is the need for more patient capital—go in with debt and equity, help companies grow, and just wait a really long time for your profit. This is working well for some, but there are limitations. Patient, or longterm, capital is bound to the performance of individual companies, which limits an investor’s ability to cultivate a more coherent development strategy—one that is consistent in terms of multiple investments working together to achieve a common development goal. While investors pick winners, we say that private sector grants start races. Grant funds provide grants to multiple companies that compete with each other and thereby foster industry growth. Many innovative first-wave businesses will not succeed but will pave the way for others who do. Grants are needed in those early stages to take risks and focus on changing market systems rather than on individual successes.

2. Working with “uninvestable companies”

We have seen some of the best innovation come from established businesses in Africa that are often difficult for investors to work with because they are either too big or too small, or are family-owned and resistant to outside influence. Such companies account for a huge amount of private wealth in Africa, which—with the right incentives—can be redirected to activities that have a positive social impact. They have the experience and infrastructure on which to innovate, and the resources to carry on successful projects, even when follow-on investment isn’t available.

3. Working in frontier markets

Where foreign investors won’t go, funders can use grants to stimulate economic growth by working flexibly with the local private sector. This could include, for example, building factories in Somaliland, formalizing agribusinesses in post-conflict states, or working with local investors in the middle of the desert to develop a camel-milk value chain—whatever it takes to meet the local market on its own terms.

4. Paying for the sunk early-stage costs of innovation and market entry

Grants can cover the high cost of developing new technology, iterating innovation, or developing distribution networks. They can incentivize businesses to take risks on business models that benefit poor people. High-risk equity can cover these costs, but many companies across Africa resist this approach. Venture capital and angel investing have been slow to develop across Africa outside of tech, and impact investors largely look for later stage opportunities.

5. Leveraging blended finance at the right time in the right way

Funders can use grants to leverage commercial capital through guarantees or by taking a first loss. We are excited about this approach in Africa, but again see limitations. Where risk is perceived as higher than it actually is and investors are not very familiar with the market, blended finance works. Investors come in, returns exceed their previously low expectations, and everyone wins. But in cases where risk and the cost of doing business and achieving impact are actually very high, financial returns will still perform below commercial expectations and grant providers can end up subsidizing those returns unsustainably.

6. Kickstart business development service markets

Markets for business development services (BDS)—offered by management consulting firms that help companies grow and raise funds—have begun to take off in East Africa, but in many other African markets companies are still unfamiliar with the model and not yet ready to pay for the services. Quality local providers of BDS are also scarce. In these cases, more grant subsidy will be needed to kickstart sustainable BDS industries.

Our recent paper on private sector grants discusses these ideas in more detail and offers recommendations on how investors can use grants effectively, including:

- Understand perceived vs. actual risk.

- Instill discipline by requiring matching funds and commercial rigor.

- Consider profit margins, market constraints, industry potential, common timelines to profit, and models that have already failed to know when grants are appropriate and when they should stop.

- One sustainability goal is to leverage maximum private or commercial capital for each grant dollar spent. Recognize that the higher the leverage, the less essential the grant.

Our hope is that strategies like these will move us closer to a world where impact investing can work everywhere for everyone.