Africa is one of the only two regions in the world achieving growth in FDI in 2015 with a seven percent rise in projects for the continent

Sub-Saharan Africa remains one of the fastest growing regions in the world despite a relative slow down. Although, the capital value of projects was down year-on-year — from US$88.5b in 2014 to US$71.3b in 2015 — this was still higher than the 2010–2014 average of US$68b. Jobs created were down year-on-year, but, again ahead of the average for 2010–2014 according to the Ernst & Young (EY) 2016 Africa attractiveness program report.

Ajen Sita, Africa CEO at EY, said, ‘over the past year, global markets have experienced unprecedented volatility, the collapse of commodity prices’.

Sita added that Africa’s two largest markets, starting with South Africa, saw GDP growth decline sharply to below one percent and the country averting a credit rating downgrade; in Nigeria, the slowdown in that economy was impacted further by the decline in the oil price and currency devaluation pressure.

Economic growth across the region is likely to remain slower in the coming years than it has been over the past 10 to 15 years. The main reasons for the slowdown are however not unique to Africa. The continent was one of the only two regions in the world in which there was growth in FDI project levels over the past year.

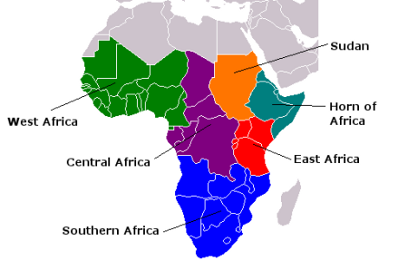

East Africa closes the FDI gap, with Kenya a big gainer

In 2015, East Africa recorded its highest share of FDI across Africa, achieving 26.3% of total projects. Southern Africa remained the largest investment region on the continent, although projects were down 11.6% from 2014 levels. The West Africa region saw a rebound in FDI projects by 16.2%. The region became the leading recipient of capital investment on the continent, outpacing Southern Africa.

North Africa experienced 8.5% year-on-year growth in FDI projects. Furthermore, while projects are increasing in North Africa, they are increasing at a much faster rate in Sub-Saharan Africa.

Historical investors gain strength

The US retained its position in 2015, as the largest investor in the continent, with 96 investment projects valued at US$6.9b. During 2015, traditional investors such as the UK and France, as well as the UAE and India, also showed renewed interest in Africa.

Over the past decade, there has also been a shift in sector focus in FDI from extractive to consumer-facing industries. Mining and metals, coal, oil and natural gas, which were previously the key sectors attracting major FDI flows, have given way to consumer products and retail, financial services and technology, media and telecommunications. This had accounted for 44.7% of FDI projects in 2015.

Managing risk

The tightening economic conditions, increasingly well-informed consumers, intensifying competition, and a heightened sense of global geopolitical uncertainty, — is now driving a change in focus toward striking a greater balance between growth, profitability and risk management.