The more the pound is rattled by public opinion, the more attention it gets from the rest of the world.

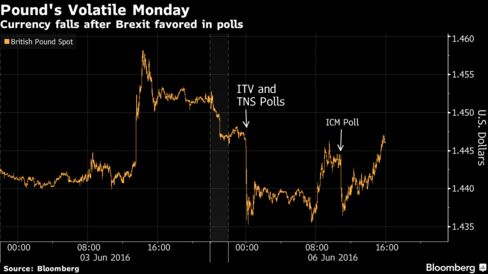

Sterling dropped to a three-week low versus the dollar after polls showed more Britons favored quitting the EU. That revived concern the June 23 referendum may throw global markets into turmoil and undermine confidence in the 28-nation trading bloc.

Three surveys on Monday showed a lead for the ‘Leave’ campaign. While the U.K. currency pared its earlier declines, a gauge of anticipated swings against the dollar in the next month surged to the highest in more than seven years. “Today’s move was a function of reality sinking in for overseas investors — the referendum will be a close outcome,” said Viraj Patel, a foreign-exchange strategist at ING Groep NV in London. “We’re probably seeing some of those long post-Brexit pound bets unwind.”

“Today’s move was a function of reality sinking in for overseas investors — the referendum will be a close outcome,” said Viraj Patel, a foreign-exchange strategist at ING Groep NV in London. “We’re probably seeing some of those long post-Brexit pound bets unwind.”

As Brexit risks become more imminent, traders and market operators around the world are preparing for the decision. Margin requirements are getting raised, trading hours will be extended London, and investors from Thailand to Boston are waking up to how their positions may be affected if Britons choose to leave the the trading bloc they’ve been in since 1973.

Impact on Growth

The Bank of England has said uncertainty surrounding the vote is hurting U.K. growth, while institutions including the International Monetary Fund and Organisation for Economic Cooperation and Development have warned of dire consequences if the nation votes to leave the world’s largest single market. Federal Reserve Bank of Chicago President Charles Evans said the referendum is undermining confidence in the global outlook at a time when the international economy is already losing momentum.

The pound dropped 0.4 percent to $1.4465 as of 4:48 p.m. in London, after earlier sinking as much as 1.1 percent to the lowest since May 16. It slipped 0.3 percent to 78.54 pence per euro, touching the weakest in more than three weeks. One-month implied volatility in the pound-dollar pair climbed above 22 percent, the highest since February 2009.

The U.K. currency will trade below $1.40 in the two weeks or so before the vote, according to ING’s Patel. The “wavering” dollar makes bets on the sterling spot rate harder, and so before the Federal Reserve’s June 15 policy decision, it’s better to buy the euro versus the pound, he said.

‘Leave’ in Lead

A YouGov Plc poll for television company ITV Plc found 45 percent would vote ‘Leave,’ compared with 41 percent opting to ‘Remain.’ A survey by global market research company TNS showed 43 percent backing an EU exit, and 41 percent wanting to stay in. An online poll showed 48 percent supported quitting the trading bloc, while 43 percent were in favor of remaining and 9 percent were undecided, according to ICM.

The pound has been a gauge of sentiment throughout the referendum debate, sliding to a seven-year low of $1.3836 in February before rallying as surveys in April and May showed the ‘Remain’ camp pulling ahead.

For an in-depth look at the polls and polling companies, click here.

“The market got carried away with itself when it seemed like the ‘Remain’ camp were extending their lead,” said John Goldie, a senior dealer at Argentex LLP, a currency advisory company in London. “Despite the most recent polls, I still get the sense that there’s an underlying expectation that the vote to remain will win, and this could be a dangerous assumption. As we move closer to voting day, if polls continue to show Brexit in with a real chance, then sterling has room to fall further.”

Conservatives Split

The polls increase the pressure on Prime Minister David Cameron in a battle that’s split the ruling Conservative Party. Chancellor of the Exchequer George Osborne has stepped up warnings of the economic consequences of quitting the EU, while former premier John Major took to the airwaves this weekend to condemn the “squalid” Brexit campaign. He dismissed its most prominent supporter, former London Mayor Boris Johnson, as a “court jester.”

‘Con Trick’

Cameron upped the ante Monday with a joint letter signed by senior figures from other political parties accusing the ‘Leave’ campaign of perpetrating an “economic con-trick” on the public.

“If a ‘Leave’ vote comes to fruition, the pound is going to get hit very, very hard because of the uncertainty around trade, around foreign direct investment,” said Chris Weston, chief markets strategist in Melbourne at IG Ltd. “You wouldn’t want to be too long-euro assets in a Brexit, because, while the pound is the initial proxy to sell, I suspect there are worse risks to Europe longer term.”

A long position is a bet a currency will strengthen. The euro was little changed at $1.1363 Monday, and slipped 0.5 percent to 1.1041 Swiss francs.

Currency markets aren’t entirely devoid of optimism for the pound. The median estimate in a Bloomberg survey puts Britain’s currency almost 2 percent stronger by the end of the third quarter at $1.47.

Even so, investors say there are other reasons to sell sterling apart from the EU vote.

“I don’t think Brexit will materialize, and the pound may relief rally after the referendum result,” said Jason Wang, chief executive officer of Singapore-based family office Stamford Management Pte. He said he would still sell the pound on any rally as the U.K.’s economic and political outlook remains bleak.