New publication on cross-border mobile money remittance models in West Africa

GSMA is pleased to release a new case study which highlights early results from a promising new model for cross-border remittances. In this model, which is rapidly emerging across East and West Africa, mobile money is used as both the sending and the receiving channel. This paper draws insights from two early examples in the West African Economic Monetary Union (WAEMU), where member states are socio-economically integrated and adoption of mobile money has been rapid in recent years.

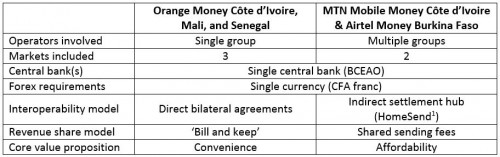

- Orange Money International Transfer links up Côte d’Ivoire, Mali and Senegal, and is the first example of mobile money transfers between three markets, enabling six distinct remittance corridors.

- The partnership between MTN Mobile Money in Côte d’Ivoire and Airtel Money in Burkina Faso is the first case of operators from separate groups agreeing to interoperate their mobile money services for international transfers.

Overview of West African cross-border transfer initiatives covered in this paper

In both cases, thanks to strong pre-existing mobile money foundations, adoption has been very strong and transaction volumes have grown substantially faster than domestic P2P transfers in these markets. A range of use cases is driving uptake, including regular and seasonal remittances from diaspora populations, as well as cross-border trade. The success of both initiatives indicates the readiness of consumers in mature mobile money markets to send and receive cross-border transfers using their mobile money account.

This paper also highlights some interesting technical, commercial, and operational insights from these early implementations that should be applicable to other markets in future. These cover the selection of an interoperability model; the determination of compensation fees to balance incentives between operators; and the operational implications of managing these new transactions.

Outside the WAEMU zone, established mobile money operators that secure the permission of their central banks could also carry a significant share of remittance flows between developing countries within a short period of time. While this would be a blow to traditional remittance channels, underserved consumers would stand to benefit from much more affordable, convenient, and secure money transfer services.

2015_MMU_Mobile-money-crosses-borders_New-remittance-models-in-West-Africa

(Source: ![]() )

)